In the intricate world of accounting, mastering the art of invoicing is essential. As projects grow in complexity and clients increase in number, accountants must navigate the billing landscape with precision and tact. It’s not just about getting numbers right—it’s about providing thorough communication and maintaining robust financial health for both providers and clients. In this article, we’ll explore key facets of invoicing within the scope of accounting, crucial for those embarking on this career path. Keep reading to uncover insights for impeccable invoicing practices.

Understanding the Basics of Invoicing in Accounting

Alt text: A team in an office discussing invoicing a project during a meeting

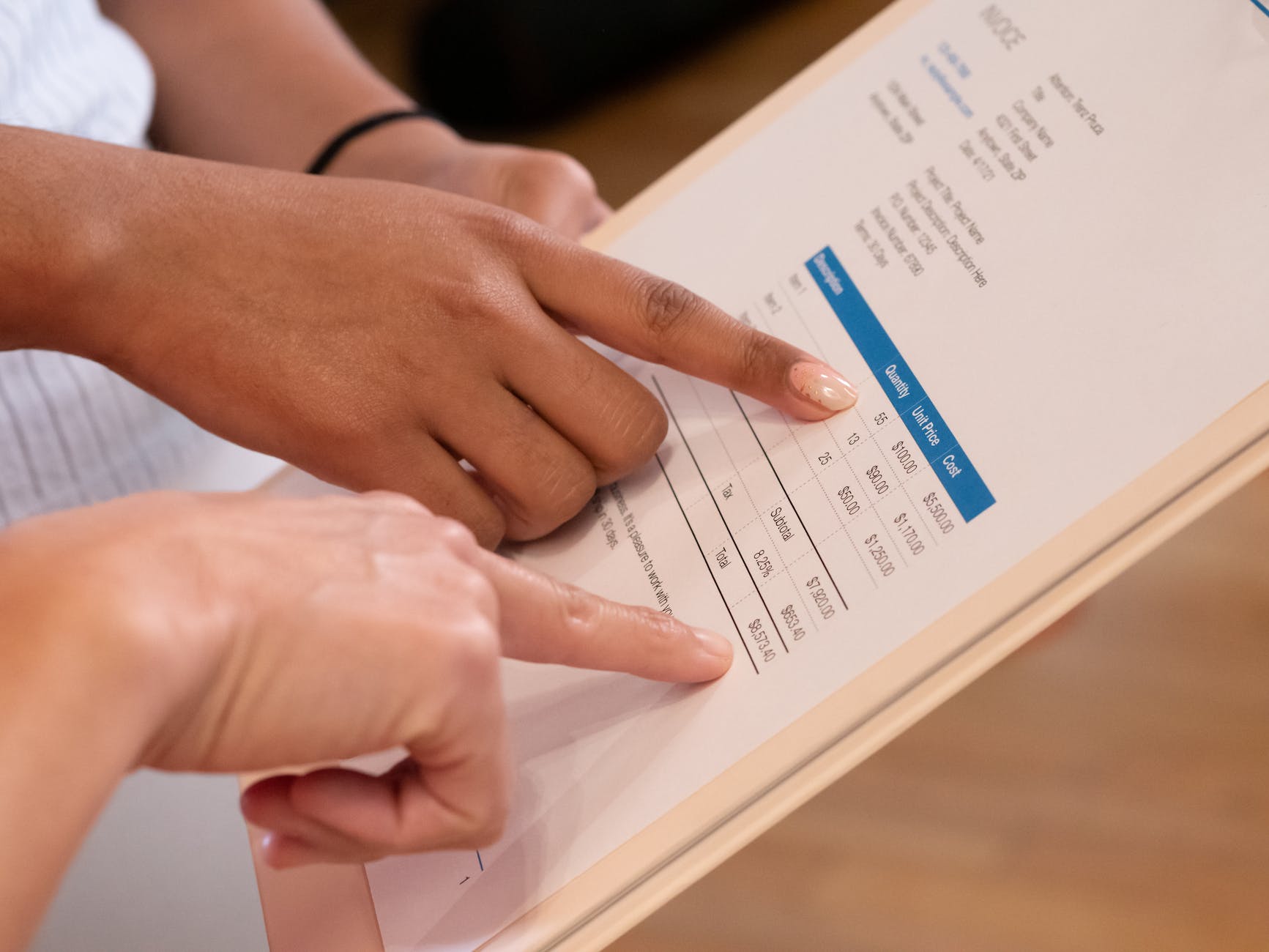

At the core of financial transactions lies the invoice—a detailed statement of the work performed, products provided, and the amount due. Aspiring accountants must appreciate this foundational document’s role as a tool for clear communication between parties. It encapsulates contractual obligations, itemizing charges to inform clients what they’re paying for, and when payment is expected.

New practitioners can start by gaining experience with manual invoices. However, with the shift towards digitalization, e-invoicing is becoming the norm. This move not only streamlines the billing process but also offers a trail of documentation that’s helpful for any future audits or financial clarifications. Moreover, electronic invoices can be integral components to invoicing a project, particularly in regard to time-tracking and project management.

Ensuring Legal and Tax Compliance in Invoice Management

Compliance with legal and tax requirements adds another dimension to the invoicing process. Invoices function as legal documents, and therefore they must conform to the standards and regulations set forth by governing bodies. This includes the proper documentation of sales tax, VAT, or other relevant taxes that apply to the services or products provided.

Accountants play an instrumental role in maintaining the financial integrity of a business. They must be aware of the various tax jurisdictions and rates applicable to the transactions they are billing. With businesses increasingly going global, this may involve understanding international tax laws and currency exchange considerations as well.

For those considering a career in accounting, it’s worth exploring educational pathways, such as earning an associate’s degree in accounting online. This can provide foundational knowledge in financial principles, including invoicing, taxation, and compliance, to prepare aspiring accountants for the complex responsibilities they will encounter.

Crafting Clear and Detailed Invoices for Clients

The clarity of an invoice can directly impact the speed and reliability of payments. When designing an invoice, accountants must strive for transparency, which eases the client’s review process. A detailed, itemized list of services, categorized appropriately, eliminates confusion and builds trust. Each entry should explain the nature of the charge and corresponding quantities or hours billed. Clear communication through invoicing promotes timely compensation and fosters a positive client relationship.

The inclusion of payment terms is another critical element. Terms such as net 30 or due upon receipt set clear expectations and avoid misunderstandings. Late payment policies should also be stated upfront, including any potential interest rates or penalties for overdue accounts. This emphasizes the seriousness of the transaction and encourages clients to stick to the agreed-upon schedule.

Moreover, the invoicing process is an opportunity to reinforce brand identity. Including the company logo, adhering to brand color schemes, and maintaining a professional layout to align invoicing with other business communications. Consistency across these touchpoints amplifies brand recognition and demonstrates attention to detail.

Implementing Efficient Invoicing Software for Accuracy

Alt text: A man in an office researching invoicing a project on his computer

In the age of automation, leveraging invoicing software stands as a hallmark of efficiency. These digital systems ensure accuracy by eliminating common human errors, such as miscalculations or omission of billable hours. Furthermore, they can generate reports, maintain records, and sometimes even send automatic payment reminders to clients, thereby aiding in the management of cash flow.

The choice of software can make a significant difference. Options vary from basic tools that generate simple invoices to comprehensive systems that integrate with time-tracking, expense management, and customer relationship management software. Accountants should select options that align with their firm’s size, complexity of transactions, and specific industry needs.

Altogether, the invoicing process encapsulates more than just sending out bills. It is a multifaceted aspect of accounting that demands accuracy, efficiency, and keen attention to detail. It acts as the underpinning of strong client relationships and robust financial practices. Overall, a meticulous approach to invoicing will contribute significantly to an accountant’s success, ensuring a reputation for reliability and expertise within the financial industry.