Unpaid invoices may negatively impact your company’s financial viability and waste time and resources. Client not paying invoice may be a stressful and demanding scenario. You must solve the problem quickly and accurately if you want your money. When dealing with a client that does not pay an invoice, use these steps:

- Initial communication and reminder

The first step in handling overdue bills is to contact the client. Non-payment is frequently the consequence of a simple misunderstanding. Here’s how you tackle it:

- Reminder to be polite

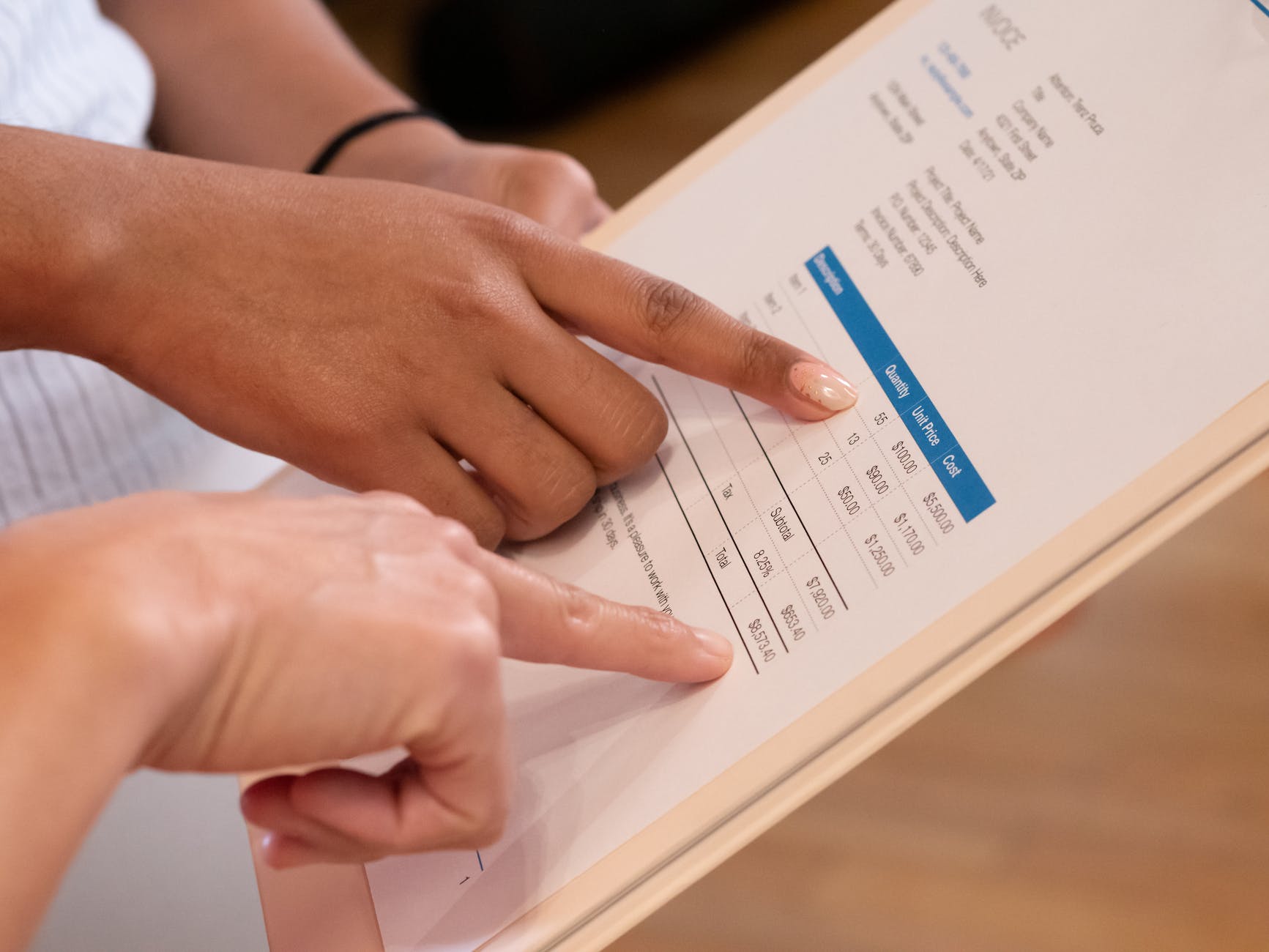

Send the client a friendly reminder email or letter. Include a copy of the invoice, the unpaid amount, and the due date again. Clarify any late penalties or interest charges that may apply to payment if not made on time.

- Several communication channels

If you do not receive a response to your reminder, consider using phone calls or other modes of communication. A personal touch can sometimes help reconcile misunderstandings.

- Increase the intensity of the problem.

If your early reminders go ignored, it’s important to escalate the situation to underline the significance of payment:

- Demand letter format

Send a formal letter of demand. This letter should include:

- The amount owing

- The due date

- The penalties for failure to pay

Make it clear that you are willing to take more action if required.

- Certified mail or read receipt email

Send the demand letter by certified mail or email with a read receipt to guarantee that the customer confirms receipt.

- Consider alternative payment options.

In rare situations, customers may be experiencing financial challenges that prevent them from completing complete payments immediately. Consider alternate configurations such as:

- Payment schemes

- Provide a payment plan allowing the client to pay the outstanding balance in installments over a certain period. Also, this can assist them in managing their finances while guaranteeing you receive the whole amount.

- Hire a debt collection agency.

If all attempts to contact and negotiate have failed, it may be necessary to seek the services of a respectable debt collection agency:

- Expertise in debt collection

Debt collection organizations specialize in retrieving overdue bills. They have the experience, resources, and legal understanding to negotiate the complexity of debt collection.

- Higher success rates

These organizations have a track record of successful debt collection. They employ proven strategies, such as:

- To locate debtors

- Negotiate settlements

- Initiate legal proceedings

- Time-saving

Hiring a debt collection firm relieves you of the pressure of collecting unpaid bills, enabling you to focus on your primary company operations.

- Taking legal action

If all other measures fail and the debt remains unpaid, you may need to consider taking legal action:

- Court of small claims

If the amount owing falls within the jurisdictional limit, you can bring a lawsuit in small claims court. Prepare to show evidence of the debt and your collection efforts.

- Consult a lawyer

Consult a debt collection professional to discuss legal options for large debts or more complex instances.

Dealing with a client who does not pay an invoice may be challenging and demanding. However, by following these steps, you may effectively handle the problem, from early conversation and reminders through escalation, alternative payment arrangements, and, if required, involving a debt collection agency or taking legal action. Always approach each level with professionalism, patience, and tenacity. As a result, you may be able to protect your company from:

- Financial security while keeping a dedicated

- Receive your money