A good CIBIL (Credit Information Bureau India Limited) score plays a crucial role when it comes to loan approval chances. Financial institutions use your CIBIL score to assess creditworthiness and decide whether to approve or reject your loan application. A higher score indicates responsible financial behavior, increasing the likelihood of approval for loans at favorable terms. If you’re wondering how to increase your CIBIL score quickly, this comprehensive guide will provide actionable strategies you can use to improve your credit score fast.

Understanding CIBIL Score: Why It Matters

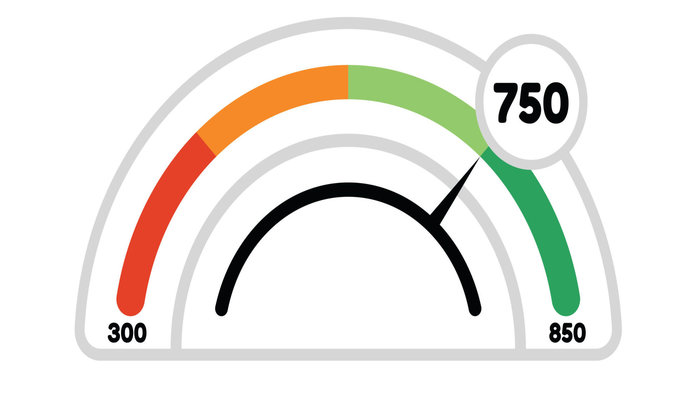

Your CIBIL score is a three-digit number ranging from 300 to 900, with 900 being the best CIBIL score. This score is primarily influenced by factors such as your repayment history, credit utilization ratio, length of credit history, types of credit used, and the number of recent credit inquiries.

Financial institutions generally consider a CIBIL score of 750 or above as ideal for loan approvals. A higher score improves your chances for approval and also helps you negotiate better interest rates. Conversely, a poor score may result in loan rejections or higher interest rates. Improving your score can make all the difference in your financial outcomes.

How to Increase CIBIL Score Fast: Proven Strategies

Boosting your CIBIL score requires patience and consistent effort. However, targeting specific actions can yield faster results. If you’re wondering how to increase CIBIL score, follow these practical tips to enhance your credit score:

1. Pay Off Outstanding Dues in a Timely Manner

A history of late payments or overdue balances heavily impacts your CIBIL score. Paying off outstanding debts—whether credit card bills, EMIs, or other loan repayments—on time signals responsible credit behavior. Additionally, set up auto-payments or calendar reminders to ensure timely payments for all future dues.

2. Maintain a Low Credit Utilization Ratio

Your credit utilization ratio, which is the percentage of your available credit you use, significantly influences your score. It’s advisable to keep your utilization below 30% of your total limit. For instance, if your combined credit card limit is ₹1,00,000, ensure your total spending does not exceed ₹30,000 in any given month.

This demonstrates that you aren’t overly reliant on borrowed funds and can handle credit responsibly. If necessary, request a credit limit increase or consider spreading spending across multiple cards to lower your utilization ratio.

3. Diversify Your Credit Portfolio

Lenders prefer borrowers who demonstrate the ability to handle different types of credit, such as secured loans (e.g., car or home loans) and unsecured loans (e.g., personal loans or credit cards). A balanced mix of credit shows responsible financial practices and positively affects your overall score. While diversifying your credit, ensure you’re regularly paying off installments and avoiding unnecessary borrowing.

4. Avoid Multiple Loan or Credit Card Applications

Each time you apply for a loan or credit card, lenders check your CIBIL score by performing a hard inquiry, which temporarily reduces your score. Avoid applying for multiple loans or credit cards within a short span of time, as this signals credit desperation. Instead, limit applications to cases where you are highly confident of approval.

5. Correct Errors in Your CIBIL Report

Errors in your CIBIL report, such as incorrect loan closure status or wrongly reported late payments, can lower your score. Regularly review your credit report to identify inaccuracies. If you find errors, raise a dispute with CIBIL immediately to correct them. A cleaner report boosts your score significantly.

6. Close Unnecessary Credit Accounts

Having too many open credit accounts can negatively affect your CIBIL score. If you have old or unused credit cards or accounts, consider closing them, but only after clearing any dues. However, keep older credit accounts in good standing as they contribute positively to your credit history length.

7. Use a Secured Credit Card

If your score is on the lower side, getting a secured credit card backed by a fixed deposit can help. Make small purchases on the card and pay back the amount in full each billing cycle. This demonstrates credit-building behavior and helps improve your score gradually.

8. Avoid Settling Loans with “Settlement” Status

When you settle a loan rather than repaying it fully, it’s marked as “settled” in your credit report, which adversely affects your score. If possible, negotiate with the lender and repay in full to maintain a positive history.

9. Opt for Longer Loan Tenures

For large loans, choosing a longer tenure reduces your monthly EMI, making it easier to avoid delayed or missed payments. Ensure you always pay EMIs on time, as timely repayments have a direct positive impact on your credit rating.

10. Be Consistent and Patient

Your CIBIL score doesn’t increase instantly—it takes time and consistency. Following the above strategies diligently over a period will help you achieve and maintain the best CIBIL score.

How Long Does It Take to Improve Your CIBIL Score?

Improving your score is a gradual process, but some strategies, like clearing outstanding dues and correcting errors on your credit report, can yield quicker results, often in 30 to 60 days. However, building a strong and long-lasting score may take six months to a year of consistent efforts.

What Is the Best CIBIL Score for Loan Approval?

The best CIBIL score is generally considered to be 750 and above. This score improves your chances of loan approval, better interest rates, and favorable repayment terms. If your score is below 700, focus on strengthening it using the strategies outlined above to improve financial opportunities.

Conclusion

Your CIBIL score is more than just a number—it’s an indicator of your financial health and an essential factor for loan approval. If you’re looking for ways to increase your CIBIL score fast, focus on timely payments, maintaining low credit utilization, diversifying your credit portfolio, and regularly reviewing your credit report for any discrepancies.

Achieving the best CIBIL score requires consistent financial discipline and responsible borrowing practices. Whether you’re planning to take out a personal loan, car loan, or home loan, a higher CIBIL score will not only improve your likelihood of approval but also ensure better loan terms. By adopting these proven strategies, you can quickly work towards increasing your score and securing your financial future.