Owning a credit card certainly has a lot of advantages. If you suddenly need to pay for an emergency, repair a broken appliance, or settle hefty medical bills, having one can give you some financial flexibility, especially if payday is still a few weeks away. However, it’s important to note that not a lot of people enjoy the privilege of being a responsible credit card owner.

In 2019, it was reported that credit card use in the Philippines remains low due to its stringent application process. If you’re not good at managing your finances or your credit history is a bit erratic, your chances of getting approved for one is unlikely. But, thanks to innovations in the credit industry, the financial landscape has become more inclusive, and people now have more ways to pay off debts.

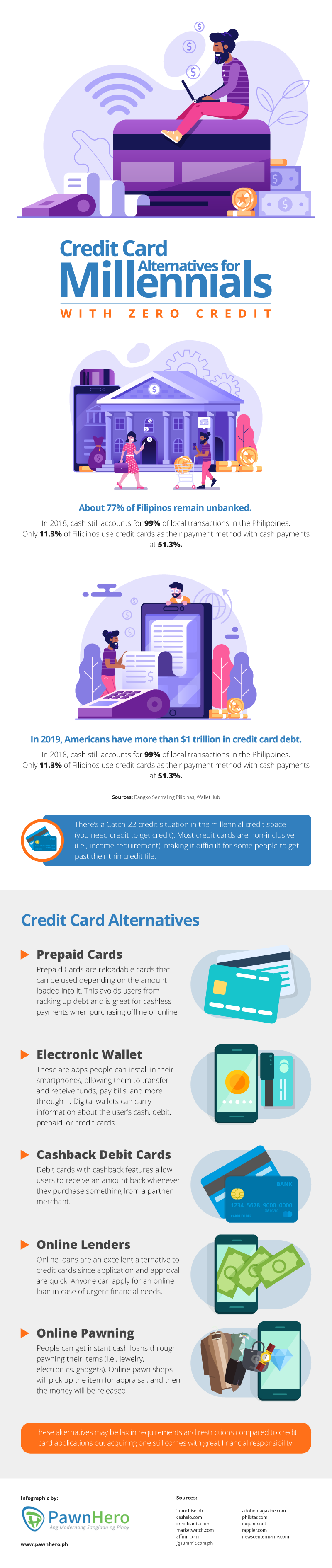

Nowadays, there are several credit card alternatives that you can take advantage of. The infographic below will discuss everything you need to know about these financial services that can help you ease your situation.