Bookkeeping is an integral part of running a successful business. It refers to the recordation and management of financial transactions to ensure that the accounts are accurate and updated. For many entrepreneurs, especially those just starting, knowing what to do with regard to bookkeeping can be really overwhelming. But with proper guidance and tools, it will become a manageable and indispensable part of your business. This beginner’s guide takes you through the basic knowledge of bookkeeping to build a solid foundation for the finances of your business.

Understanding the Basics of Bookkeeping

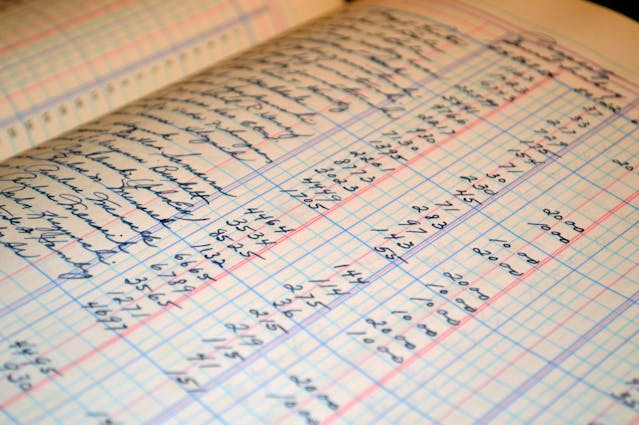

Bookkeeping is essentially the recording of financial transactions in an orderly manner. That means sales, purchases, payments, and receipts. Good bookkeeping is important in maintaining a record of income and expenses, as well as managing cash flow and preparing for tax time. First, you must know some key terms like debits and credits, ledgers, and trial balances. Knowing them will guide you through all your financial reports and ensure the accuracy and completeness of your records.

Choosing the Appropriate Accounting Method

The two methods used for bookkeeping are cash basis and accrual basis. According to the cash basis method, revenues and expenses occur when cash is received and paid. This method is simple to apply. As a result, this method is appropriate for small businesses primarily because most of their transactions are cash-based. In the accrual basis method, revenues and expenses occur as they are incurred, irrespective of when cash changes hands. This process is more descriptive, but it will give you a clearer picture of your finances, especially if you have accounts receivable or payable. Understanding how these two procedures work one against the other will make you decide which one is effective for your purpose.

System of Bookkeeping

Having a reliable bookkeeping system can make all the difference between being cool and becoming chaotic. It may be the use of either the old pen-and-paper system or the digital means through accounting software. Many small business owners like using QuickBooks or Xero as it makes things easy. The calculation is automatic and generates a report. In the case of using software, it has to be easy to operate and serve your needs appropriately. At the bottom line, though, is consistency. Start keeping records of all transactions and get into the habit of not having backlog to prevent confusion later.

Why Bookkeeping in Small Business?

Good small business bookkeeping lets you understand your financial condition. It gives you an idea of whether you are profitable or not, controls your expenses, and helps to trace trends that will affect the future of your business. Good bookkeeping practices make it easy to have an overview of your finances, which is important in making any decision. True, accurate records make the tax preparation process easier, with less likelihood of missing some deductions or facing penalties. You can always pay forward all that time and energy going into bookkeeping when you control your finances while reaching better business goals.

Seek Professional Help

Many small business owners start by doing their bookkeeping independently; however, they may sometimes require professional help. One can hire bookkeepers or accountants to perform the bookkeeping, thereby saving a lot of time, as surety that their records will be accurate and in full adherence to the tax laws of the area. A bookkeeper will aid in planning and implementing a bookkeeping system for your business, managing your money, and giving information on the general financial position of your business. As one seeks a professional, observe their experience concerning your field and their in-depth knowledge in small business bookkeeping. This can be very beneficial while you focus on growing your business and let the expert sort out the financial details.

Conclusion

Bookkeeping forms one of the essential tasks in running a successful business. You must know the fundamentals, choose the correct system, and have an appropriate system that will ensure the proper maintenance of all records and keep them up to date. Whether you do it yourself or hire a professional, you need to emphasize good bookkeeping as essential to setting your business up for success. Good bookkeeping is about knowing the numbers; it’s about gaining insight from those numbers that could guide your business decisions and help in growth. So, as you navigate through the world of bookkeeping, stay committed to learning and adapting your practices to the changing needs of your business.